All employees who are employed under a contract of service or apprenticeship in the private sector and contractual temporary staff of Federal State Government as well as Federal State Statutory Bodies need to be registered and covered by SOCSO. Employment insurance eis contributions are set at 04 of an employees estimated monthly wage.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Employees pay the smaller portion depending on their income.

. For better clarity do refer to the SOCSO Contribution Rate table-----Who is eligible for SOCSO deductions and contributions. In the first category for the most part the employer is to pay 175 of the employees total salary towards the fund and the employee is. Actual monthly wage of the month First Category Employment Injury Scheme and Invalidity Scheme Second Category Employment Injury Scheme Employers Employees Total Contribution Contribution By Employer Only 1.

When wages exceed RM70 but not RM100. Rate as stated in the rate of contribution table on the socso website. If an employee wishes to continue contributing at the 11 rate they must complete The Borang.

125 Employment Injury Scheme only 0. Malaysian PR above 60 years old and Foreign Employees. Employment insurance eis contributions are set at 04 of an employees estimated monthly wage.

Employees are responsible for a lesser share which varies based on their salary. When wages exceed RM30 but not RM50. The contribution rate for the employment insurance system eis is from 02 of employer shares and 02 of the employees share of the employees monthly.

Types and Categories of SOCSO Contributions. There is often much confusion around the exact amount to be paid by the employer and employee towards the SOCSO fund. Employers SOCSO contribution rate.

All employees who are employed under a contract of service or apprenticeship in the private sector and contractual temporary staff of Federal State Government as well as Federal State Statutory Bodies need to be registered and covered by SOCSO. Age 60 and above. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

This is why this article talks about the different ways by which you can Socso contribution table 2022. 9252018 Rate Of Contributions 16 Rate Of Contribution RATE OF CONTRIBUTIONS No. Contribution table rates jadual caruman socso this is applicable for employees.

SOCSO Contribution shall be made for each month of salary payment as a deduction towards salary net pay. Following the budget 2021 announcement employees epf contribution rate for all employees under 60 years. Employers are required to contribute to SOCSO for their employees according to the SOCSO Contribution Table Rates as determined by the Employees Social Security Act 1969 Act 4.

SOCSO Contribution is a payment to Social Security Organization made by both employees and employers. When wages exceed RM50 but not RM70. Eis contribution table 2022 are set at 04 of an employees estimated monthly wage.

The rate of contribution is capped at monthly wage ceiling of RM400000. Employers need to make a 02 contribution for each of their employees. All employees who have reached the age of 60 must be covered under this category for the Employment Injury Scheme only.

But for employees with a monthly salary of more than. Employees earning more than RM3000 per month on the other hand are exempt from making the SOCSO payment. 175 Employment Injury Scheme and Invalidity Scheme 05.

The rate of contribution is capped at monthly wage ceiling of RM400000. Contribution rate of eis for socso table 2019 malaysia contributions to the employment insurance system eis socso table 2019 are. For eligible new employees who are 55 years of age.

Rates and figures mentioned below are applicable for 2021 and beyond until there is further revision. Eis contribution table 2022 are set at 04 of an employees estimated monthly wage. Wages up to RM30 40 cents 10 cents 50 cents 30 cents 2.

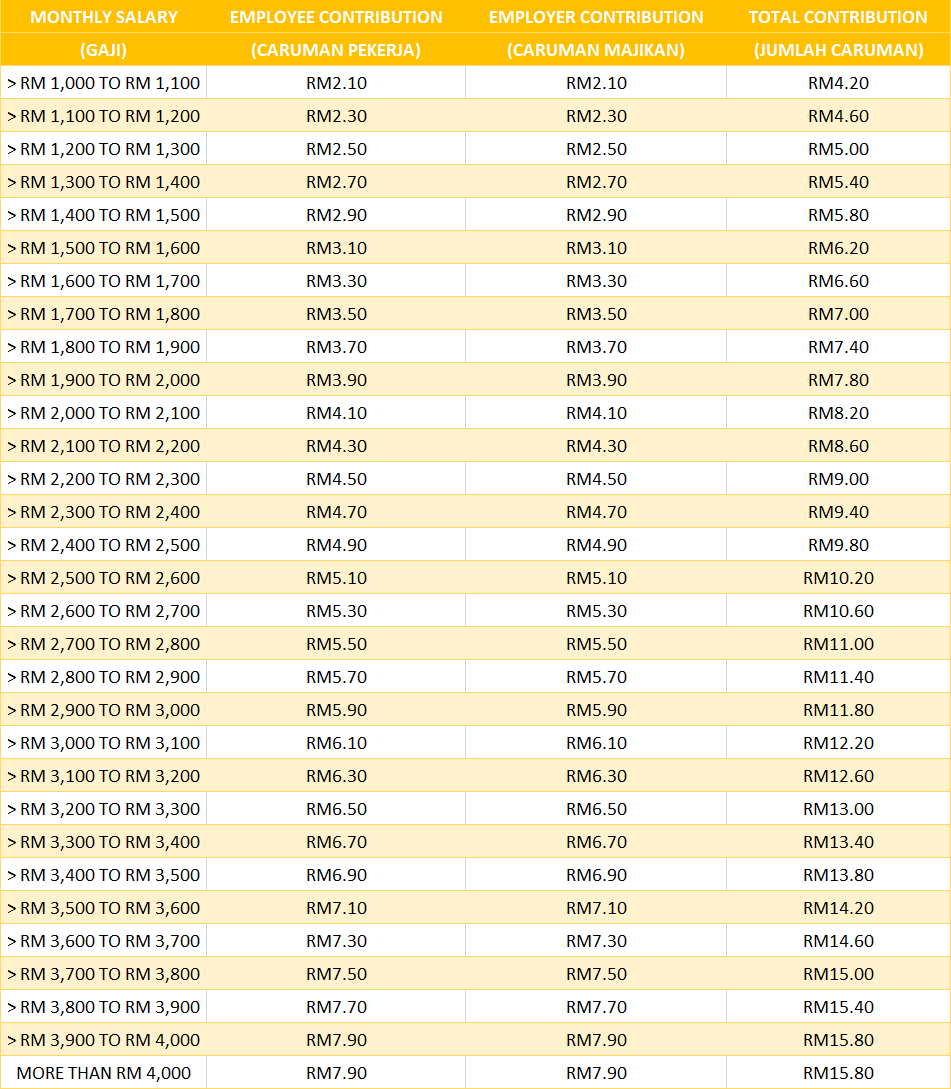

Contributions of the Second Category. The maximum eligible monthly salary for SOCSO contribution is capped at RM4000. Employers guide to epf socso eis and mtd in malaysia 55 characters.

This is applicable for employees aged below 60. A company is required to contribute socso for its staffworkers according to the socso contribution table rates as determined by the act. The contribution rate ranges from 05 to 3.

Employers will pay 175 while the employees will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. All private sector employers need to pay monthly. Contribution By Employer Only.

Employers will pay 175 while the employees will contribute 05 of their wages for the employment injury insurance scheme and the invalidity pension scheme. EPF contribution rates for employers and employees as of the year 2021 Following the introduction of budget 2021 the EPF contribution rate for all employed under 60 years old is cut by default from 11 to 9 from February 2021 to January 2022. ١٦ ذو القعدة ١٤٤٣ هـ.

SOCSO Contribution chart. The rate of contribution under this category is 125 of employees monthly wages payable by the employer based on the contribution schedule. Rate as stated in the rate of contribution table on the socso website.

The percentage of SOCSO Contribution shall between 3 to 5 of the employee salary vary accordingly to the employee salary amount. 2021 socso eis contribution. SOCSO payments should be made by both employers and employees whenever possible.

125 Employment Injury Scheme only 0. The contribution rate varies between 05 percent and 3 percent. Eis contribution table 2022 are set at 04 of an employees estimated monthly wage.

Employers and employees contribution rate for epf as of the year 2021. Both employers and employees should contribute to SOCSO payments. In simple terms there are two categories of the SOCSO fund.

Employees SOCSO contribution rate. Malaysian PR below 60 years old Employee. Wages up to RM30.

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Changes To Malaysian Employment Law Social Security And Minimum Wage Conventus Law

Eis Perkeso Eis Contribution Table Eis Table 2021

5 Things About Socso Perkeso You Should Know

Socso Contribution Table Rates Jadual Caruman Socso Nbc Com My

Malaysia S New Insurance System Automatically Asklegal My

Socso Contribution Rate Table 2020 Kimaku

Rate Of Contributions Pdf 5 2 2019 Rate Of Contributions 5 2 2019 Rate Of Contribution Rate Of Contributions No Actual Monthly Wage Of The Course Hero

Socso Contribution Rate Table 2020 Kimaku

6月1号开始 Socso 最新的kadar Caruman Sql Account Oneplus Facebook

Myfreelys Academy Pekerso Definition Of Wages For Socso Contribution Purpose Wages For Contribution Purposes Refers To All Remunerations Payable In Money By An Employer To An Employee Among The Remunerations Are

Rate Of Contributions Pdf 5 2 2019 Rate Of Contributions 5 2 2019 Rate Of Contribution Rate Of Contributions No Actual Monthly Wage Of The Course Hero

Socso Contribution Rate Table 2020 Kimaku

![]()

New Update In Socso Table 2020 For Payroll System Malaysia

Socso Rate Of Contributions Pdf 9 25 2018 Rate Of Contributions Rate Of Contribution Rate Of Contributions No 1 Actual Monthly Wage Of The Course Hero

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Socso Contribution Chart Table Rates Chart Contribution Employment